If you are new to the world of credit lines in a business. Then choose the right place to about credit lines in a business. Well, you have possibly seen in any business that usually business owners require connection to all working assets to expand his business more frequently in the market.

Although the greatest running and prosperous businesses have incidents with late hidden debts, crucial unplanned payments, products expenses, and other temporary conditions where money flow is lacking than before. In these situations, it is advised to acquire or save some more capital as a fund that can help you for many reasons like business advancements or competing in the market through difficult times and launching new brands.

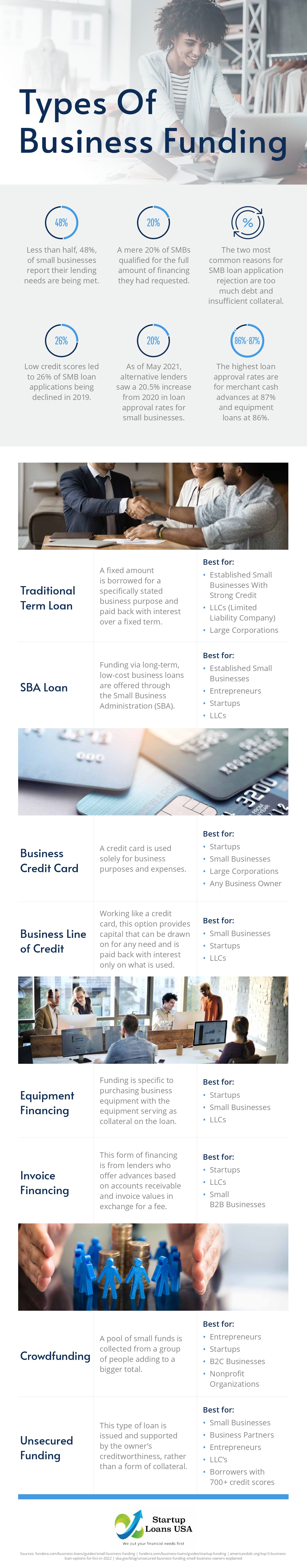

For any business funding, there are so many different choices are available to choose. For example, government schemes, bank loans, marketing of big companies, getting sponsorships, etc. The business lines of credit are one of the best options for your business growth and financing to compete with the other business owners in the market. To know more about a business line of credit, learn more about business financing, and how do they work and are used in the market.

How do the business lines of credit work?

The business lines of credit are considered as the sum of capital as a fund that a business owner can take as a loan from it when he urgently needed it and can return the money at another time. In contrast to the other old short-term debts, a business owner can invest these funds in his tough times and when he/she needs capital for a business product acquirement like pieces of machinery, items supply, delivery, and other business setup expenses. In a short-term loan, there is a fixed time for money pay-back with extra interest, while in a business credit line a business owner can repay the loan anytime, without any stress and extra interest payments. Business lines of credit are capital that can be used by a business owner as funds for up to his accepted amount need, then return the capital that he/she has used to gain the profit from funds offered. For a business line of credit, it doesn’t matter that you want a small or a large amount of capital for small or big business.

Moreover, fixed-term loans are the business capital loans that any business owner can take for a limited time and return the money with a high-interest rate. There is a risk of failure with quick loan repayment and the unwanted stress of business setup and its outcomes in fixed-term loans. However, if any business owner has a business line of credit in the main option to select, then, he/she can handle the situations like a business failure, product services challenges, loan repayment with interest, and other business expenses with no fear and stress to invest the capital that she/he will require in future.

Infographic provided by Startup Loans USA, a business startup loans company